nebraska tax withholding calculator

12 rows Income Tax Withholding Reminders for All Nebraska Employers Circular EN. A detailed transaction summary is available.

Accounting For Agriculture Federal Withholding After New Tax Bill Unl Beef

The income tax withholding to be deducted is determined according to the methods in Reg-21-004.

. Details of the personal income tax rates used in the 2022 Nebraska State Calculator are published below the. This income tax calculator can help estimate your average income tax rate and your salary after tax. There are four tax brackets in Nevada and they vary based on income level and filing status.

Our calculator has been specially developed in. Click image to enlarge Set up company tax information option. How many income tax brackets are there in Nebraska.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. The lowest tax rate is 246 and the highest is 684. If the work of a nonresident employee is performed entirely in Nebraska his or.

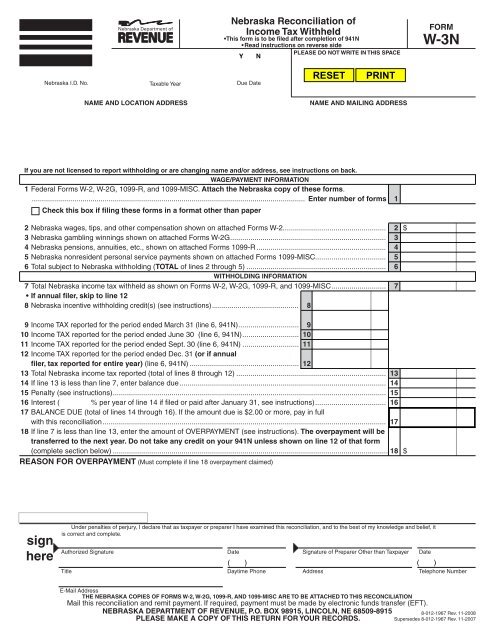

Nebraska Income Tax Withholding Return Form 941N Nebraska Monthly Income Tax Withholding Deposit Form 501N Nebraska Reconciliation of Income Tax Withheld Form W-3N Federal Forms W-2 and 1099 File Form 941N Frequently Asked Questions Benefits of the Form 941N online system It uses a simplified 7-line form. Long- and short-term capital gains are included as regular income on your Nebraska income tax return. All tables within the Circular EN have changed and should be used for wages pensions and annuities and gambling winnings paid on or after January 1 2022.

The Nebraska Department of Revenue is issuing a new Nebraska Circular EN for 2022. That means they are taxed at the rates listed above 246 - 684 depending on your total taxable income. The Nebraska Form W-4N is completed by the employee to determine the number of allowances that the employer uses in conjunction with the Nebraska Circular EN to calculate the Nebraska income tax withholding.

Calculate your Nebraska net pay or take home pay by entering your per-period or annual salary along with the pertinent federal. Income Tax Withholding Reminders for All Nebraska Employers Circular EN. The value of the Nebraska allowance is.

The Nebraska Department of Revenue is issuing a new Nebraska Circular EN for 2022. If youre a new employer congratulations on getting started you pay a flat rate of 125. There are no local income taxes in.

In 2012 nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. All tables within the Circular EN have changed and should be used for wages pensions and annuities and gambling winnings paid on or after January 1 2022.

Submit or give Form W-4 to your employer. Select the rigth Pay Period Start ezPaycheck application click the left menu Company Settings then click the sub menu Company to open the company setup screen. Form W-3N Due Date.

100 rows Nebraska Capital Gains Tax. 00601 An employer must deduct and withhold Nebraska income tax from all wages paid to an employee who is a nonresident of Nebraska for services performed in Nebraska. Free for personal use.

State copies of 2021 Forms W. Ask your employer if they use an automated system to submit Form W-4. As an employer in Nebraska you have to pay unemployment insurance to the state.

The Nebraska Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Nebraska State Income Tax Rates and Thresholds in 2022. Instead you fill out steps 2 3 and 4. To change your tax withholding amount.

Nebraska Salary Tax Calculator for the Tax Year 202223. Nebraskas state income tax system is similar to the federal system. Skip to main content.

Form W-3N Due Date. Calculate net payroll amount after payroll taxes federal withholding including Social Security Tax Medicare and state payroll withholding such as State Disability Insurance State. 2022 Payroll Tax and Paycheck Calculator for all 50 states and US territories.

Its a progressive system which means that taxpayers who earn more pay higher taxes. Free federal and nebraska paycheck withholding calculator. This Nebraska bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses.

The state income tax system in. The state sales tax in Nebraska is 550. To keep your same tax withholding amount.

If youre in the construction industry your rate is 54. The state income tax rate in Nebraska is progressive and ranges from 246 to 684 while federal income tax rates range from 10 to 37 depending on your income. Please make sure you select the correct Pay Period there.

You are able to use our Nebraska State Tax Calculator to calculate your total tax costs in the tax year 202223. You dont need to do anything at this time. 2022 Payroll Tax and Paycheck Calculator for all 50 states and US territories.

The Nebraska bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. Calculate net payroll amount after payroll taxes federal withholding including Social Security Tax Medicare and state payroll withholding such as State Disability Insurance State. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

Nebraska tax withholding calculator. The 2022 rates range from 0 to 54 on the first 9000 in wages paid to each employee in a calendar year.

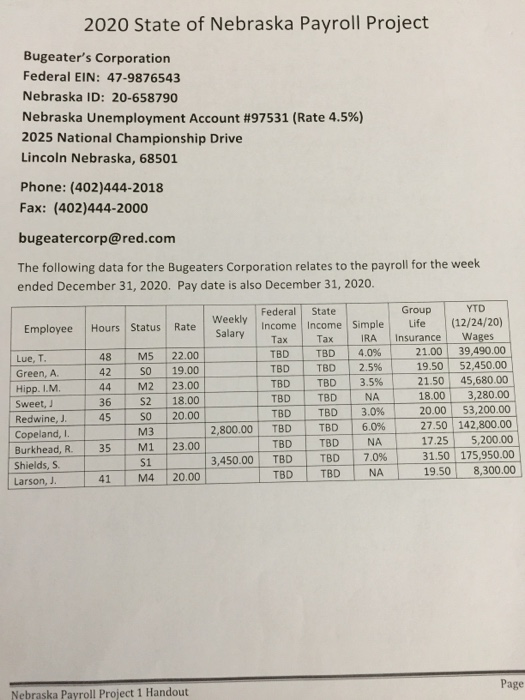

I Really Need Your Help Please Help Me I Need Get Chegg Com

1040ez Tax Calculator Nebraska Energy Federal Credit Union

2019 Withholding Tables H R Block

W 3n Nebraska Department Of Revenue

I Really Need Your Help Please Help Me I Need Get Chegg Com

Nebraska Paycheck Calculator Updated For 2022

Nebraska Paycheck Calculator Smartasset

State W 4 Form Detailed Withholding Forms By State Chart

Nebraska State Tax Tables 2022 Us Icalculator

Nebraska Paycheck Calculator Smartasset

Free Nebraska Payroll Calculator 2022 Ne Tax Rates Onpay

Nebraska Payroll Taxes A Complete Guide

W 4 State Withholding Tax Calculation 2020 Based On The State Or State Equivalent Withholding Certificate